paytech Achieves PCI DSS Level 1: Elevating Payment Security and Trust

Client Case Studies

Here we’ve gathered real cases of our clients and provided detailed descriptions of them, from challenge and problem to describing the implementation and subsequent benefits.

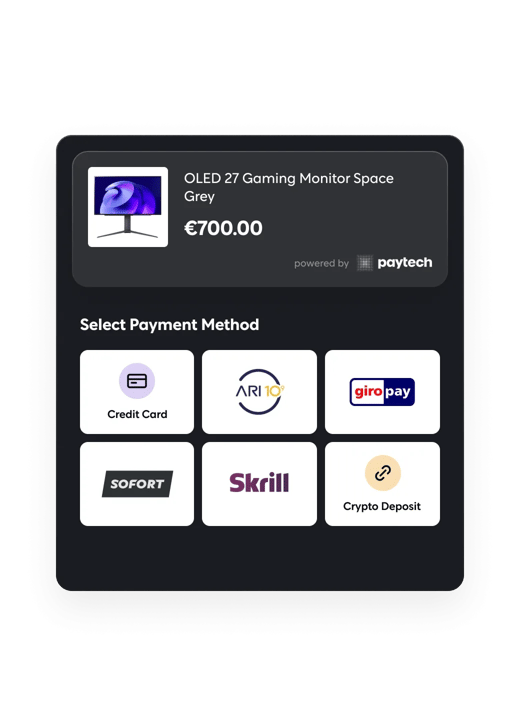

White Label Payment Gateway

How Fyntek Scaled a Niche Payment Operation with paytech

Fyntek set out to build a specialised payment company in one of the fastest-growing digital sectors in the United States.

Despite the founder’s extensive industry background, the US gateway landscape presented clear limitations:

-Existing gateways were not connected to smaller, agile acquirers.

-There was no support for cascading or failover, making it difficult to maintain stable approval rates.

-Onboarding processes were slow, preventing fast go-to-market strategies.

-New operators were unable to build the processing history required by Tier-1 acquirers.

Building and maintaining this infrastructure in-house would have required significant time, internal resources, and ongoing development, making rapid scaling nearly impossible.

To overcome these limitations, Fyntek partnered with paytech to build a flexible acquiring setup tailored to its operational needs.

Using paytech’s white-label gateway and integrations hub, Fyntek was able to:

-Connect with multiple smaller acquirers capable of low-cap acquiring.

-Establish a cascading flow to ensure uninterrupted processing.

-Create a foundation that would allow them to eventually transition into higher-cap, Tier-1 acquiring as volume and history increased.

This unified setup gave Fyntek the infrastructure needed to launch quickly, operate reliably, and scale confidently.

With paytech’s adaptable infrastructure, Fyntek was able to:

-Integrate 12 acquirers in just 45 days, enabling a multi-acquirer setup from day one.

-Implement smart routing, cascading, and failover to maintain high approval ratios.

-Onboard merchants quickly through streamlined, flexible flows.

-Access real-time monitoring, analytics, and reporting to scale operations efficiently.

This setup allowed Fyntek to launch in January and begin processing its first live transactions by the end of February, without relying heavily on in-house development.

The collaboration enabled Fyntek to focus on growth, product development, and customer experience, while paytech handled the complexity of integrations, routing, and operational performance.

The result is a high-performing, future-ready payment infrastructure built for rapid expansion and long-term resilience — powered by paytech.

White Label Payment Gateway

Powering Dice Rabbit to scale payment operations globally

Dice Rabbit was scaling across multiple regions and needed to manage complex payment flows efficiently.

Each market had unique PSP requirements, currencies, and regulations, resulting in fragmented integrations, inconsistent approval rates, and growing operational challenges.

Building and maintaining these systems in-house would have required significant time and resources — limiting their ability to scale quickly.

To streamline payment operations and enhance performance, Dice Rabbit partnered with paytech to deploy a fully white-labelled payment gateway.

This unified platform provided complete control over integrations, analytics, and routing logic — all under Dice Rabbit’s own brand identity.

With paytech’s flexible infrastructure, Dice Rabbit was able to:

-Integrate hundreds of local payment methods and acquirers across markets.

-Implement smart routing and cascading to maintain high approval ratios.

-Access real-time monitoring, analytics, and onboarding tools for greater operational visibility and autonomy.

This allowed Dice Rabbit to expand confidently without relying heavily on internal development resources.

Faster expansion into new markets with minimal friction.

Higher and more consistent approval rates.

Reduced downtime through automated failover mechanisms.

Greater scalability with lower technical overhead.

The collaboration empowered Dice Rabbit to focus on growth and client experience, while paytech handled the complexity of global payment orchestration.

The result was a stable, high-performing infrastructure built for scale and long-term reliability.

By leveraging paytech’s technology, Dice Rabbit transformed its payment infrastructure into a robust, scalable and brand-controlled environment. Enabling faster growth, improved reliability and sustainable performance across all markets.

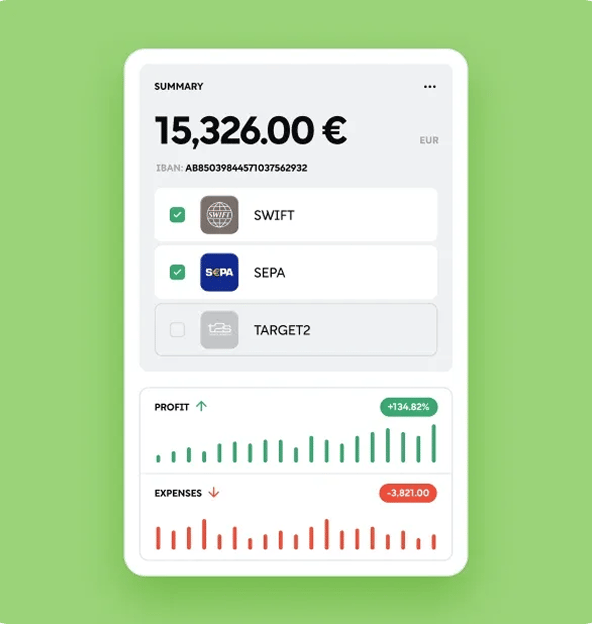

White Label Payment Gateway

Accelerating growth in the

european market with

paytech

White Label Gateway

Nicheclear, a payment processor and e-money distributor, faced the challenge of establishing a reliable infrastructure while navigating complex regulatory requirements. Time was of the essence, and Nicheclear needed a robust solution to swiftly launch their services and foster sustainable growth.

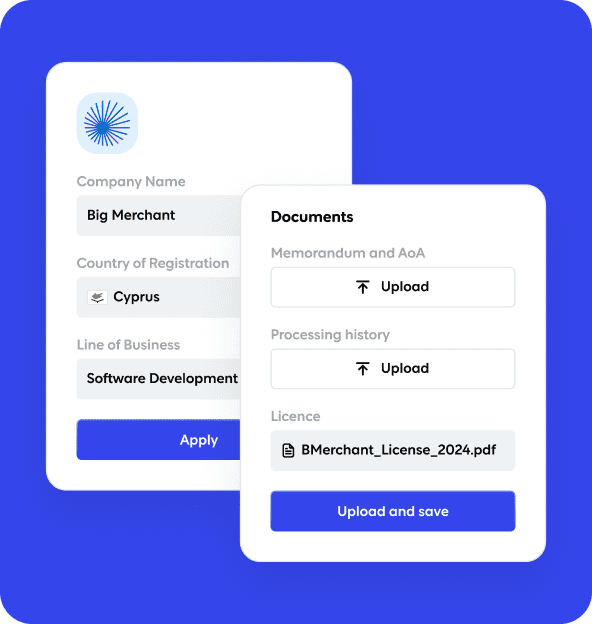

Recognising the need to hit the ground running, Nicheclear partnered with paytech White Label Banking to accelerate their market entry and propel their business forward. Leveraging the cutting-edge capabilities of the platform, Nicheclear seamlessly integrated with multiple banking providers, streamlining their operations and maximizing their agility. With paytech's expertise, Nicheclear swiftly achieved regulatory compliance, allowing them to focus on their core business offerings and customer engagement.

With paytech's expedited implementation process, Nicheclear was operational in just two weeks. The platform's flexible infrastructure enabled Nicheclear to build an onboarding, screening, and verification workflow that also offered industry-leading, robust security measures which provide peace of mind for both the company and their customers.

Embracing paytech White Label Banking proved transformational for Nicheclear. Within a year, they had successfully launched their services and gained a strong foothold in the European market. The ability to issue IBANs via their banking partner for Merchants provided a unique value proposition, attracting a diverse clientele and accelerating revenue growth. With reliable support and 24/7 customer assistance from paytech, Nicheclear consistently delivered exceptional financial services, earning accolades from their satisfied customers and solidifying their position as an industry leader.

White Label Payment Gateway

Empowering Atlantic B.V. with a

seamless

Payment Gateway

solution.

Atlantic B.V., operating under the website slottica.com, sought a robust and versatile payment gateway to streamline their payment processing operations. Their unique requirements included implementing features such as Smart Routing, Separation of First Time Deposits, and VIP traffic, along with the need for a Settlement Calculator. Moreover, the challenge of seamlessly combining processing with both fiat acquirers and crypto processors demanded a comprehensive and flexible solution.

Turning to paytech for their payment gateway needs, Atlantic B.V. found the perfect fit for their diverse requirements. paytech's innovative technology and industry-leading capabilities provided the ideal solution to cater to the distinct needs of slottica.com.

The integration of paytech's payment gateway into slottica.com was executed swiftly and seamlessly. paytech's team of experts ensured that Smart Routing, Separation of First Time Deposits and VIP traffic, and the Settlement Calculator were all integrated efficiently to match Atlantic B.V.'s specifications. Additionally, paytech's flexible platform enabled the seamless combination of fiat acquirers and crypto processors for a holistic and seamless payment processing experience.

The successful implementation of paytech's payment gateway provided Atlantic B.V. with a wide array of benefits, including:

Smart Routing: Enhanced payment success rates through intelligent routing options.

Separation of Traffic: Improved customer segmentation for targeted promotions and enhanced user experience.

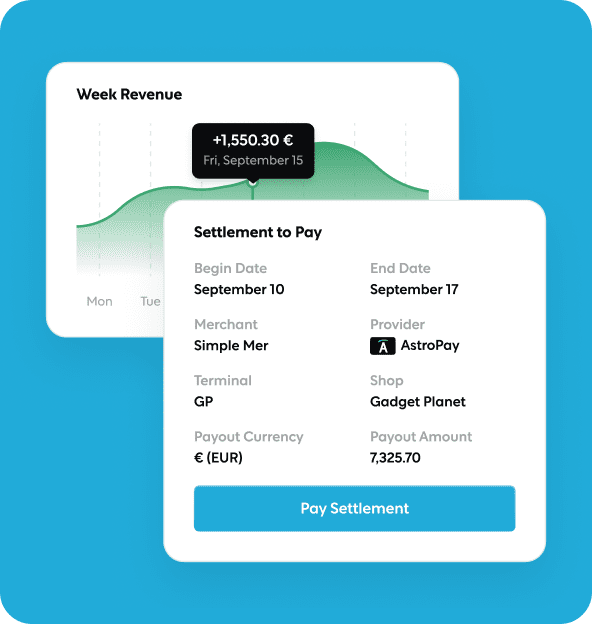

Settlement Calculator: Simplified financial management with accurate and real-time settlement calculations.

Fiat and Crypto Processing Integration: A unified and seamless payment experience for both traditional and cryptocurrency payments.

White Label Payment Gateway

Accelerating growth in Asia with

paytech

White Label Payment

gateway.

Xazur, a dynamic payment services company, sought to establish a strong foothold in the booming markets of Asia. With a specific focus on local payment methods and rapid market entry, Xazur needed a reliable and comprehensive solution to quickly process payments, manage finances, and seamlessly reconcile transactions.

Choosing paytech White Label Payment Gateway proved to be the game-changer for Xazur. Our platform's cutting-edge technology, exclusively tailored to their needs, provided a robust, all-in-one solution that encompassed payment processing, financial management, settlement, and reconciliation.

With paytech's expedited setup, Xazur was operational within record time, enabling them to enter the markets of Asia promptly. paytech's deep network of local payment providers was swiftly integrated, offering Xazur a diverse range of payment methods to cater to their target audience.

Xazur embraced paytech's technology wholeheartedly, using it exclusively to power their entire payment ecosystem. From processing payments with ease and accuracy to efficiently managing finances, the platform enabled Xazur to optimize their operations and drive revenue growth.

Focus on Asia: paytech's expertise in the region ensured seamless integration with local payment providers, giving Xazur access to a wide array of payment methods tailored to the preferences of their customers.

Swift Market Entry: Thanks to paytech's efficient setup process, Xazur quickly launched and began generating revenue in their target markets, gaining a competitive edge in the rapidly evolving payment industry.

All-in-One Solution: By leveraging paytech's comprehensive platform, Xazur efficiently handled payment processing, financial management, settlement, and reconciliation, streamlining their entire payment ecosystem.

Customizable Modern Interface: paytech's modern interface provided Xazur with a customizable experience, enabling them to align their brand identity and create a user-friendly environment for their clients.

White Label Payment Gateway

Streamlining payment

integrations and

optimizing R&D

costs with paytech.

Exim Technologies LTD, a leading player in the payment solutions industry, sought to expand their payment options and connect with numerous payment providers swiftly. However, the complexity and time-consuming nature of integrating new solutions posed significant challenges. Additionally, the rising costs of Research and Development (R&D) further drove the need for a cost-effective and efficient solution.

Recognizing the potential benefits of a strategic partnership, Exim Technologies LTD engaged paytech as their integrations hub. Leveraging paytech's expertise and reputation as an exceptional integrations partner, Exim Technologies LTD outsourced their complex integrations to streamline operations and optimize costs.

Embracing the role of the integrations hub, paytech executed a seamless integration process that enabled Exim Technologies LTD to connect with new payment providers in record time. paytech's agile approach and deep understanding of Exim Technologies LTD's requirements resulted in an expansive range of payment options for their customers, driving enhanced user experience and market growth.

The partnership with paytech yielded remarkable benefits for Exim Technologies LTD:

Efficient Integration of New Solutions: paytech's expertise in integrating new payment solutions allowed Exim Technologies LTD to rapidly expand their payment options, enhancing their competitive edge and customer satisfaction.

Optimized R&D Costs: By outsourcing complex integrations to paytech, Exim Technologies LTD optimized R&D costs, allowing their team to focus on enhancing their core technologies and innovation.

Enhanced Market Reach: With swift and seamless integrations, Exim Technologies LTD broadened its market reach and effectively met the diverse payment preferences of its customers.

Exim Technologies LTD's collaboration with paytech proved instrumental in streamlining payment integrations and unlocking efficiency. By leveraging paytech's exceptional expertise and acting as their trusted integrations hub, Exim Technologies LTD achieved rapid connections with new payment providers, driving growth and expanding their market presence.

paytech's commitment to excellence and cost-effective solutions allowed Exim Technologies LTD to optimize R&D costs and focus on core innovations. As a result, Exim Technologies LTD is now better positioned than ever to meet the evolving payment needs of their customers and maintain their status as a leading player in the payment solutions industry.

White Label Payment Gateway

Empowering Paynamo to

transform payment

solutions

across Latin America

Paynamo, a pioneering payment solutions provider in Latin America, aimed to revolutionize the regional payment landscape by offering the most cost-effective services compared to their competitors. To achieve this goal, they needed to integrate multiple payment methods directly with local banks and providers, eliminating intermediaries. However, this ambitious endeavor was faced with challenges due to the diverse range of APIs, outdated legacy systems, and variations in API development approaches across the region.

With a determined vision to reshape the payment landscape in Latin America, Paynamo partnered with paytech to create a transformative payment solution. paytech's expertise in complex integrations, combined with their commitment to innovation, made them the ideal choice to tackle this ambitious project.

Overcoming various hurdles such as differing time zones and API complexities, paytech's skilled team collaborated closely with Paynamo to implement dozens of complex integrations with local banks and payment providers. By excluding intermediaries and directly integrating with each payment method, paytech facilitated a streamlined and cost-effective payment ecosystem for Paynamo.

Through this remarkable collaboration, Paynamo achieved remarkable milestones:

Comprehensive Regional Coverage: In just five months, paytech and Paynamo successfully covered the entire Latin American region, offering an expansive array of payment methods that catered to diverse customer preferences.

Competitive Pricing: By eliminating intermediaries and offering direct integrations, Paynamo surpassed its competitors by providing the most cost-effective payment solutions in the region.

Modernizing Payment Landscape: Paynamo's transformative approach revolutionized the payment landscape in Latin America, leaving a profound impact on the industry and customer experience.

Our clients’

feedback.

At no point have we ever felt a supplier–client dynamic! We’ve always felt like one team. Thank you — actually, a BIG MASSIVE THANK YOU — for being there with us through every step. The second year already promises to be massive.

Jean-Paul

Founder, GatoWay

We knew exactly what we wanted to build — we just needed a platform that could keep up. paytech connected every acquirer we needed, delivered on every timeline, and helped us scale at a speed that surprised even us.

Alex

CEO, Fyntek

With their platform, we barely need our own developers — everything just works out of the box. Integrations are smooth, stability is amazing, and their team is always there in real time. Honestly, we’re just happy to work together and keep growing side by side.

Sergei

CEO, Dice Rabbit

Roman Andriichuk

Director, Exim Technologies LTD

They customised their white label payment gateway to our exact specifications, and the platform's flexibility made it possible for us to offer customers more choice and a much better checkout experience.

Alina Tatarina

Director, Atlantic B.V.

Their white-label payment gateway became our sole solution for payment processing, financial management, and reconciliation. We swiftly integrated a plethora of local payment providers in India and Asia, and paytech's expertise and unwavering support have been invaluable as we grow.

Herinder Bedi

CEO, Xazur

Their commitment to excellence and regional expertise meant they were the perfect fit. We couldn't have done it without them.

Daniel Anderson

CEO, Paynamo

The level of adaptability is impressive. We can switch providers, test new routes and optimise performance without disruption. paytech makes it easy.

Oskar Strandh

Founder, Nicheclear

01

8

Contact

our Sales

team.

team.

Provide your information to help our Sales

team better understand your needs.

Thanks for enquiring

with us.

with us.

We’ll contact you directly to get things

moving – we may ask you for additional

information about your enquiry.